Introduction

Baumol’s (1996) seminal work on institutions and entrepreneurship is a historical account comparing different civilizations and the incentives those institutions create. Sobel (2008) performed the first empirical test of Baumol’s hypothesis that different institutions will promote productive, unproductive, or destructive entrepreneurship by developing a net entrepreneurship index at the U.S. state level for the year 2000. Having been cited more than 1,000 times, Sobel’s (2008) study has proven to be highly influential in the study of entrepreneurship. However, the index is (now) quite dated and is limited to only a single year. Leveraging several newly created datasets, we reenvision Sobel’s net entrepreneurship index in a panel framework to re-test Baumol’s hypothesis over time and provide other researchers with a new resource for exploring empirical questions related to productive and unproductive entrepreneurship.

We construct productive, unproductive, and net entrepreneurship indices for 381 metropolitan statistical areas (MSAs) from 2002 to 2019 with data measures similar to Sobel (2008). Using MSA data allows us to examine how changes in different measures of entrepreneurship correlate with economic outcomes at geographies that align more closely with entrepreneurial ecosystems (Johnson et al., 2022). Our findings support Baumol’s (1996) assertions and reconfirm Sobel’s (2008) evidence that productive and unproductive measures of entrepreneurship correlate strongly with desirable and undesirable economic outcomes. More importantly, the extended indices we develop will allow other researchers to further advance our understanding of institutions’ essential roles in shaping entrepreneurial decisions.

Key Findings

- This report creates an MSA- and state-level index of net productive entrepreneurship from 2002-2019.

- We define net productive entrepreneurship as productive less unproductive entrepreneurship.

- Net productive entrepreneurship scores can change drastically for an individual MSA over time.

- There is substantial within-state variation across different MSAs. For example, the MSA with the highest net productive score (San Jose) is in the same state as the two MSAs with some of the lowest scores (Los Angeles and Sacramento).

- Our index strongly correlates with income per capita and employment rates

- The index provides an avenue for researchers to apply and test Baumol’s hypothesis on productive and unproductive entrepreneurship.

Literature and Background

While many consider entrepreneurship a young field, it has a long and multidisciplinary history. Many consider the research to have begun in the 17th century with Richard Cantillon and in the 18th century with classical economists Adam Smith and Jean Baptiste Say. At the turn of the 20th century, economists, including John Bates Clark and Frank Knight, continued to develop the field. In the latter half of the 20th century, Austrian economists such as Joseph Schumpeter, Ludwig von Mises, F.A. Hayek, and Israel Kirzner espoused the importance of entrepreneurship in the economy (Landstrom, 1999).

Landstrom (1999) argues that the roots of entrepreneurship are not only deep but wide, involving a multidisciplinary approach that includes economics, psychology, sociology, and management. More recently, Urbano et al. (2019) provides a literature review of entrepreneurship and institutions and the link between the two in promoting economic growth. Citing the work of North (1990, 2006), Acemoglu et al. (2014), Baumol (1996), and Rodrik (2003), Urbano et al. (2019) note that these authors argue that institutions affect economic growth indirectly, rather than directly. Schumpeter (1949), Leibenstein (1968), Baumol (1996, 1994), and Baumol and Strom (2007) all suggest that entrepreneurship is an important influence on economic development and economic performance for short- and long-term growth (Urbano et al., 2019).

According to Urbano et al. (2019), Sobel (2008) is among the top scholars who have written on the connection between entrepreneurship and institutions. Among the papers that cite Sobel (2008), many have hundreds of citations each. A major limitation of Sobel’s (2008) index, noted by Cumming and Li (2013), is that it is only cross-sectional, so any findings cannot be proven robust over time.

Several studies, such as Cumming and Li (2013) and Estrin et al. (2013), have attempted to examine how institutions affect entrepreneurship using panel data. Although more limited in scope, these studies are generally consistent with Sobel’s (2008) findings. More recently, Chowdhury et al. (2019) extends the work of Sobel (2008) and Cumming and Li (2013) and estimates the effects of institutions on entrepreneurship across developed and developing countries. Although these studies are empirical and expand on the concepts outlined by Baumol (1996) and Sobel (2008), none directly uses or extends Sobel’s index. Thus, none has a net entrepreneurial measure. Our paper reenvisions Sobel’s index to directly expand the net entrepreneurial measure over time and in areas that align with entrepreneurial ecosystems.

Data and Index Compilation

We combine data from several sources to construct our time-varying Net Productive Entrepreneurship (NPE) Index for metropolitan statistical areas (MSA) in the United States. While our index includes the same broad components as Sobel (2008), our data sources differ because we take advantage of several unavailable databases at the time of Sobel’s work.

Sobel (2008) claims the key measures of productive entrepreneurship include venture capital expenditures, the growth rate in the number of sole proprietors, the number of patents awarded, the total birth rate of the establishment, and the birth rate of the large firm. We also include a new measure of innovation—the number of patent applications— as an additional measure of productive entrepreneurship. According to the United States Patent and Trademark Office, approximately half of all patent applications are ultimately awarded a patent, so omitting applications may underestimate local innovation.

The first newly developed database we leverage is the PatentsView database published by the United States Patent and Trademark Office. This database was first published in 2012 and provides disambiguated patent award and application information that includes the latitude and longitude of inventors. This data allows us to measure patent-related innovation at a sub-state dimension precisely.

Additionally, we measure employment and establishments using the Your Economy Time Series (YTS) database. This database, first publicly released in 2016, is a collaborative effort between a private-sector marketing company (Data Axle) and the University of Wisconsin Business Dynamics Research Consortium. The goal of YTS is to capture the universe of business establishments operating in the U.S., including owner-only (or nonemployer) establishments. If one’s objective is to measure productive entrepreneurship, including owner-only establishments in business counts would be the most inclusive measure of entrepreneurial activity. In addition to establishment-level employment counts, YTS provides each establishment’s latitude and longitude and its primary North American Industrial Classification System (NAICS) at a six-digit level. This microgeographical data allows us to provide a more nuanced analysis of productive and unproductive entrepreneurship than Sobel (2008) was able to provide.

Our final measure of productive entrepreneurship, venture capital expenditures, is from the Dow Jones VentureSource database. Using verified proprietary information on hundreds of actual venture capital financings, Andre and Braun (2020) find the VentureSource data to be among the most accurate sources of venture capital funding. A complete description of our variables and source information is provided in Table 1.

Turning our attention to the unproductive component of entrepreneurship, these variables include the number of lobbying establishments, lobbying employment concentration, and State Liability Systems (SLS). Lobbying establishment and employment, both from the Your Economy Time Series database, are from the North American Industry Classification System sector 541820. This sector includes establishments that provide lobbying, political consulting, or public relations consulting.

SLS comes from the U.S. Chamber of Commerce’s Institute for Legal Reforms. The SLS is state-level survey data from about 1,300 in-house general counsels, senior litigators or attorneys, and other senior executives at large companies. In this survey, they are asked to grade (A through F) their states on the following areas: enforcing meaningful venue requirements; overall treatment of tort and contract litigation; treatment of class action suits and mass consolidation suits; damages; proportional discovery; scientific and technical evidence; trial judges’ impartiality; trial judges’ competence; juries’ fairness; and quality of appellate review. They are then converted to 0–100 scores for each state. The surveys were conducted in 2002-2008, 2010, 2012, 2015, 2017, and 2019. For the missing years, we use linear interpolation.

For each of the variables, we standardize them individually using:

Standardizedit = (Yit − MeanYi)/(StdDevYi), (1)

where each variable in a given MSA at time t (Yit) is subtracted by the mean of the entire sample and then divided by the standard deviation of the entire sample. Standardized values are then averaged across the six productive entrepreneurship variables to obtain a Productive Entrepreneurship Index (PEI). Similarly, the three standardized unproductive variables are averaged to form the Unproductive Entrepreneurship Index (UPI). The Net Productive Entrepreneurship Index (NPE) is therefore given by:

NPEit = PEIit − UEIit. (2)

To create an index of net productive entrepreneurship at the state-level, Sobel (2008) used Borda count. We instead standardized each variable and averaged those standardized variables. Both have the advantage of being able to adjust variables that have different units (scores, count, percentage). However, one shortcoming of Borda count is that it implies that the difference between one state and another is the same, regardless of the actual gap. Standardizing retains the magnitude of differences between variables.

However, standardizing can be sensitive to particular outliers in the distribution. This approach is still an improvement over a 0-10 scale based on minimum and maximum values, another common indexing approach. In the case of much of our data, a 0-10 or 0-1 scaled index would provide stark and misleading differences. For instance, many MSAs have zero venture capital or lobbying establishments, while other MSAs have extremely high scores of venture capital per capita (like Boulder, Colorado, in 2018, which had venture capital per capita of $2258.80). Similarly, 2059 MSA-unit observations had 0 lobbying establishments, and another 1284 had just one. On the other hand, New York City had the seven highest number of establishments, ranging from 761 to 984. Forcing a 0-10 scale in this case would lead to a disproportionately heavier weight on New York and Los Angeles (who consistently had the two highest concentrations of lobbying establishments), while giving the MSAs in between the maximum and minimum very small scores. Doing so would cause MSAs that had high amounts of lobbying establishments (but not compared to New York or Los Angeles) to score closer to 0. For example, if we imposed a 0-10 scale on this variable, MSAs with 30 lobbying establishments would receive a score of 0.5; MSAs with 100 lobby establishments would have a score of just above 1. However, an MSA that has 800 lobbying establishments would receive a score of 9. This method would impose and assume a close to 1-point difference between MSAs with 984 and 800 lobbying establishments and those with 100 and 0 lobbying establishments.

Results

Index Score

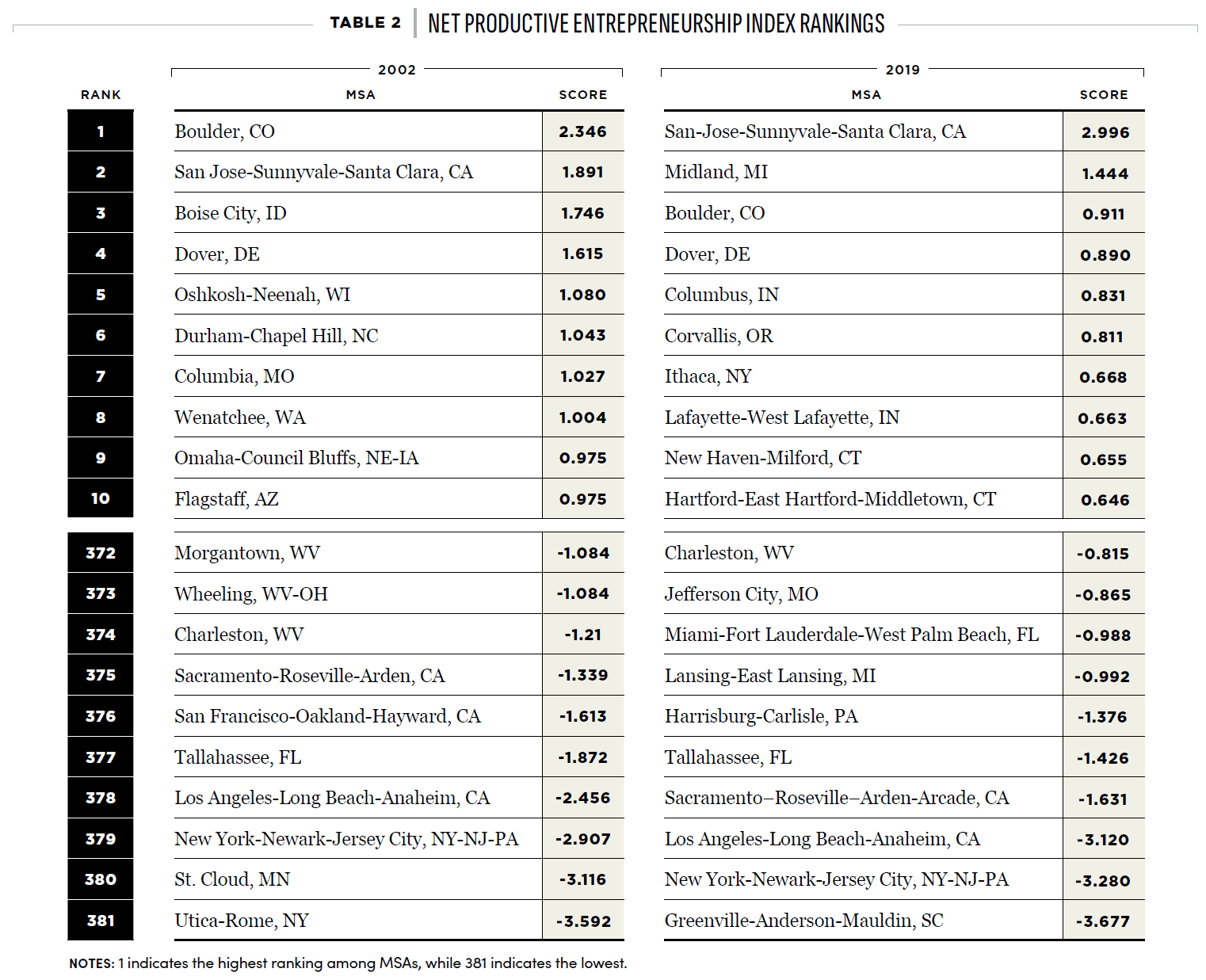

We report the top 10 and bottom 10 ranking MSAs in our index for the first (2002) and last (2019) years of our sample in Table 2. Some areas retained a high ranking, such as Boulder, CO; San Jose, CA; and Dover, DE, which stayed in the top 10 in 2002 and 2019; similarly, some areas always ranked low. New York, NY; Los Angeles, CA; Tallahassee, FL; and San Francisco, CA, were in the bottom 10 at both ends of the sample.

Scores of the top 10 were much lower in 2019 than in 2002, suggesting a decline in NPE over time. Hartford, CT, for example, scored 0.646 in 2019, earning the 10th spot in that year; the same score in 2002 would have them ranked just 51st. Furthermore, the 10th spot in 2002 (Flagstaff, AZ) scored over fifty percent to that of Hartford, CT, in 2002. Areas can also move drastically over time. Almost half of the MSAs (9 of the 20) in the top 10 or bottom 10 in 2002 were no longer in those spots by 2019.

Next, we rank all 47 MSAs with populations of one million or more in 2002 (Table 3). Scores were reported in 2002 and 2019. There are several interesting findings. First, there are 21 MSAs with negative scores in 2002 and 25 in 2019. Very few MSAs had a positive increase from 2002 through 2019. Scores can shift quite drastically as well. For example, Seattle, WA, was second in 2002; by 2019, Seattle was just 25th. Similar shifts occur on the positive side as well. Philadelphia, for example, went from 25th to 5th from 2002 to 2019, having its score increase by 0.306.

We illustrate the importance of a time-varying index by reporting the MSAs with the 10 largest increases and decreases in 2002 through 2019 in Table 4. Utica-Rome, NY, had the largest increase over the sample, moving from the lowest score of 381 to 35th by 2019. Even high-ranking states can improve over time. San Jose, CA, had the third largest increase over the sample, even though they ranked 2nd in 2002. Boulder, CO, on the other hand, had the 4th largest decrease from 2002 to 2019, but only dropped three spots (from first to fourth).

Consistent with the literature on declining business dynamism within the United States (Bennett, 2021, 2019), we, too, find that the average NPE scores tend to fall over time, although the complete picture is nuanced. Table 5 reports the average NPE scores across all MSAs, the 47 most populated MSAs, and all other MSAs from 2002 through 2019. The average scores dropped only slightly, going from 0.089 in 2002 to 0.039 in 2019. Years between, however, are inconsistent. The year 2002 is followed by four straight years of below average NPE, then two years of around average NPE, then negative during the years of the Great Recession. There was a spurt of high NPE from 2016 to 2018. Interestingly, we find that the declining NPE trend is largely driven by more populated MSAs. In almost every year (except for five), NPE in smaller MSAs is larger than in the more populated MSAs.

Innovation is a local phenomenon (Wagner and Bologna Pavlik, 2020), justifying our use of a local-level measure of net productive entrepreneurship rather than at the state-level. To further emphasize this point, we take the average NPE scores of three highly populated states in 2002-2019. Starting with California (Table 6), we find that the scores vary drastically by MSA. One of the highest-scoring MSAs, San Jose, CA, has an average score of just over 3, while Los Angeles, CA, is -2.923. Twenty-two of the 26 MSAs in California receive a negative, or below-average, score in NPE. For Texas, we see less variance but still notable differences across space. Austin, TX, scores the highest, despite its larger than average lobbying given its status as the state capitol; Corpus Christi, TX, is a notable outlier in the state, having a score of over two standard deviations lower than average. Houston, TX, and College Station, TX, both score above average. Finally, in New York, we observe an even more stark difference. New York City and Utica score very low and are the only two MSAs in the state with a negative average value (-2.2 and -1.2, respectively), while most other areas, particularly Albany and Ithaca, score fairly high.

Further evidence of the spatial variation in NPE, even within a state, is illustrated in Figure 1. Panel A shows the average MSA NPE score for the sample, while Panel B shows the change between 2002 and 2019.

In terms of the average NPE score (Panel A), California, Michigan, and Pennsylvania each have at least one MSA in all four quartiles. Many states (like Arizona, Florida, New York, Oregon, Texas, and Washington) each have at least one MSA in three of the quartiles. A similar pattern emerges when one examines changes over time (Panel B). This further highlights the need for examining innovation and entrepreneurship at the local level.

Correlating Index to Economic Outcomes

In this section, we report results where we regress the NPE index on three common economic outcome variables: real income per capita, employment rates, and income inequality. These regressions are done solely to explain the correlative relationship between these variables and are not meant to represent causality. We perform simple panel regressions, where we include the NPE, the productive index, and the unproductive index separately as covariates in regressions on the outcome variables, including MSA and year-fixed effects.

Starting with income (Table 7), we find that NPE and productive entrepreneurship strongly correlates to higher incomes, while the unproductive index correlates strongly to lower real incomes (see Figure 2). A one-point (or roughly one-half of a standard deviation) increase in NPE is associated with a $686 boost in income. The effect from the productive index on its own is slightly less than double that magnitude.

Marginal effects on employment (per 100 persons) are presented in Table 8, and a scatterplot of the relationship is shown in Figure 3. Consistent with real income, the NPE and productive indices are positively correlated with increased employment rates. Conversely, the unproductive index is negatively related to employment rates, suggesting that unproductive entrepreneurship crowds out employment in the region, perhaps due to lobbying consolidating resources and lowering employment opportunities.

Finally, the relationship between the indices and income inequality are reported in Table 9 and Figure 4. While the raw scatterplot indicates that MSAs with higher NPE have lower levels of income inequality, none of the regression coefficients are statistically different from zero.

State-Level Index

We recreate the exact same index, but at the state-level. In Table 10, we show the top ten and bottom ten states in the net productive entrepreneurship measure in 2002, 2008, 2014, and 2019. Delaware consistently ranks first, while California ranks last in every year. One particularly interesting finding is that the highest scores tend to decrease over time, while the lowest ranking states increase over time. For example, Delaware had a NEP score of 1.816 in 2002, 2.122 in 2008, but 1.576 in 2019. California, on the other hand, had a score of -1.329 in 2002 but -1.050 in 2019. Generally speaking, the highest ranked states in 2002 had higher scores relative to states in 2019 at the same rank. The same holds true for the lowest-ranked states.

We then compare the average scores from 2002-2019 and rank by NPE score. For simplicity we report only the top and bottom fifteen states (see Table 11). This table reveals two paths states can take to have high NPE scores. The first is to have high productive scores and low unproductive scores, like Delaware, Minnesota, and Virginia. Another route is having low/below-average productive scores but having very low unproductive scores, such as Nebraska and Indiana. Similarly, low ranked states have two general paths. The first is low productive scores and high unproductive scores, like Louisiana, Mississippi, and West Virginia. The other path is high productive scores but even higher unproductive scores that offset the ”good” done from the productive sector. This is the case in California, Florida, New York, and Texas.

A core premise from Baumol’s argument is that the institutional environment influences the type of entrepreneurship the society can expect. We report scatter plots of state-level economic freedom from Stansel et al. (2023) and our NPE index, the productive index, and unproductive index (Figure 5). We find a weak relationship between economic freedom and NEP, as well as productive entrepreneurship. However, we find a strong and negative relationship between economic freedom and unproductive entrepreneurship. However, this is a simple scatter plot, and a further investigation that is beyond the scope of this paper is needed to assess any causal or even correlative connection.

Conclusion and Discussion

Motivated by the highly cited work of Sobel (2008), we develop a new resource for future researchers to use, tease out the determinants of net productive entrepreneurship, and test new theories of the relationships between net entrepreneurial activity and social and economic outcomes.

We claim this paper improves on the original work of Sobel (2008) along several dimensions. First, our indices span a long period of time (2002—2019). Next, and perhaps just as important, we measure entrepreneurial activity at a local level – metropolitan statistical areas. The justification is that innovation is a local phenomenon. For instance, look back at Table 6, which shows that scores can change quite drastically across states. In the most extreme case, San Jose, CA, receives most of the highest scores over the time period; however, Los Angeles, Sacramento, and San Francisco often score among the lowest over time. Indices constructed at the state level mask this underlying local variation.

Additionally, we outline several potential avenues of future research using this expanded index. First, there is a large literature on the impact of economic freedom on entrepreneurship at the international (Bjørnskov and Foss, 2008), state (Wiseman and Young, 2013), and metropolitan level (Bologna Pavlik, 2015; Bennett, 2021). For scholars in this field, an obvious next step would be determining if economic freedom, and which areas of economic freedom, matter for (net) productive entrepreneurship.

People vote with their feet, particularly at the local level, where it is less costly to do so (Banzhaf and Walsh, 2008; Tiebout, 1956). Do people consider the net productive entrepreneurial environment in their migration decisions? This finding seems to be a clear avenue for research. While we provide simple correlations that NPE is related to incomes and employment, work that seeks to address causality bears much consideration.

Furthermore, the seminal work on income mobility coming from Raj Chetty and his team at Opportunity Insights has provided carefully constructed measures of both relative and absolute mobility at the local level in the United States. Much of this work has considered social capital (Chetty et al., 2022), and one considers economic freedom (Callais et al., 2023). However, how a dynamic entrepreneurial environment has largely been overlooked should also be considered.

Finally, this NPE measure is only available within the United States. As other countries provide similar data, it would be fruitful to consider such scores in different countries, particularly developing countries where entrepreneurship can often be the main mechanism for avoiding poverty.